EXECUTIVE SUMMARY

The NNPDC is responsible for updating the region’s Comprehensive Economic Development Strategy (CEDS). The region includes Lancaster, Northumberland, Richmond, and Westmoreland Counties.

The Northern Neck Planning District Commission (NNPDC) was designated an Economic Development District in the year 2000 by the United States Department of Commerce Economic Development Administration.

This is a CEDSonline™ document. A printable version can be viewed and/or downloaded here. The current Northern Neck CEDS was adopted on January 21, 2022, and is updated every five years.

The Northern Neck Region of Virginia

Bounded by the Potomac River to the North, Rappahannock River to the South, and the Chesapeake Bay to the East, the Northern Neck’s economy traditionally was supported by agriculture, fishing, and forestry. Today, those industries are present, if transformed, to include hydroponics, aquaculture, and wood processing.

In recent years, the Northern Neck’s economy has become more diversified. Tourism, with supporting retail, accommodations, dining and entertainment components, is an important segment of the local economy. Additionally, the region supports businesses in marine repair and construction, precision machining, utility trailer and truss manufacturing, security training services, fiberglass pool distribution, nutrition supplement distribution, fertilizer/seed distribution, and ‘last-mile’ distribution.

CHALLENGES

The data gathered during the CEDS process reflects challenges in retaining and growing the workforce-age segment of the population, increasing regional educational attainment (including workforce certifications), and increasing the number of sites and buildings available for economic development.

POPULATION

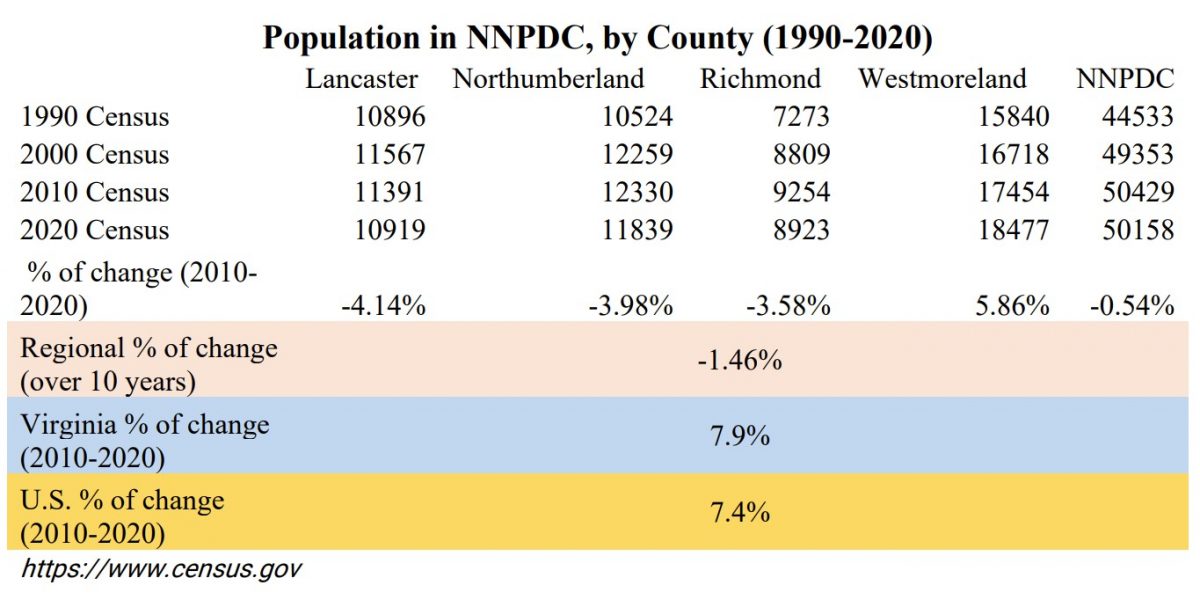

The 2020 population in the Northern Neck totals 50,158, a decrease of less than 1% (.54%) since the 2010 census. As the most populous county, Westmoreland County’s growth almost completely offset the population decline in Richmond, Lancaster, and Northumberland Counties.

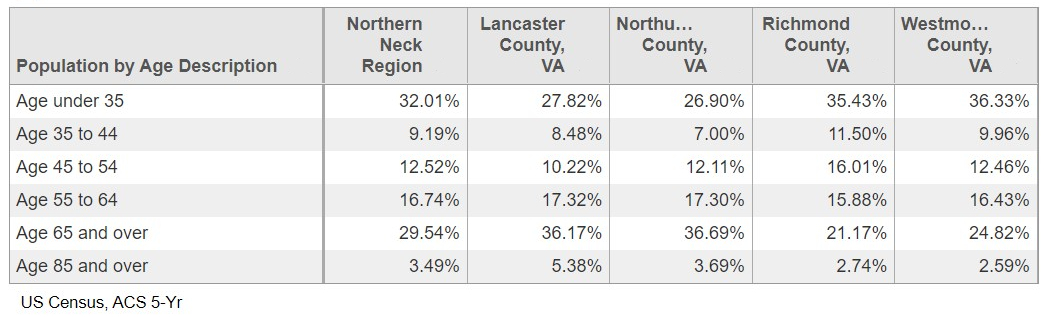

SENIOR POPULATION

The proportion of the population that is over 65 is greater in Lancaster and Northumberland Counties than in Richmond and Westmoreland Counties. Lancaster’s senior population is 36.17% of the total and Northumberland’s proportion is 36.69%, both of which have increased since the 2010 census. In Richmond and Westmoreland, seniors comprise 21.17% and 24.82% of the population, respectively, which have also increased in the last 10 years. As a region, the senior proportion is 29.54% of the population. By comparison, the state’s senior population as a percentage of the total is 15.9%.

PER CAPITA INCOME

From 2015-2019, per capita incomes ranged from $22,853 in Richmond County to $40,062 in Lancaster County. Three Counties had per capita incomes below the state’s per capita income of $39,278. Per capita incomes fell over the last 10 years.

WAGES AND INCOME

The average annual wage in the Northern Neck as of 2021Q2 was $40,319, significantly below the state average annual wage of $64,607, and national average wage of $64,141. Average wages have risen modestly in the Northern Neck region over the last 10 years.

The 2020 median household income for the region was $56,565, while Virginia’s was $76,398.

Source: https://data.census.gov/all?q=2020+Median+Household+Income

WORKFORCE PARTICIPATION

The average workforce participation rate of 61.15% is below the national rate of 63% and Virginia’s 64%. Richmond and Westmoreland Counties’ numbers bring up the average for Lancaster and Northumberland Counties.

Source: www.virginiaworks.com/_docs/Publications/Labor-Force-Participation-Rates/PDF/2021-Labor-Force-Participation-Rates.pdf

EDUCATION

Educational attainment has improved as 12% of the population is without a high school degree, which is down from over 20% in the 2018 CEDS. Nationally, 10% lack a high school diploma.

An average of 24% of the region’s population has a bachelor’s degree or higher, below the national average of 39%.

Source: US Census, ACS 5-Yr, 2012 – 2020

STRATEGIES TO ADDRESS THESE CHALLENGES

The following regional strategies have emerged to address the Northern Neck’s challenges:

BROADBAND

All industries, education, training, healthcare, and quality of life are increasingly reliant on consistent and widespread broadband coverage. In 2020, a broadband partnership among Northern Neck localities, electric utilities, and a private internet service provider was formed to provide broadband internet to the unserved areas of the Northern Neck. The project has received support from the Federal Communications Commission’s Rural Digital Opportunity Fund and the Virginia Telecommunications Initiative. The project is in the early phase of implementation. Concurrently, there are opportunities to attract new companies to the region, as suggested by a recent report from the Virginia Economic Development Partnership.

DESIGNATION AS A NATIONAL HERITAGE AREA

The proportion of the population that is over 65 is greater in Lancaster and Northumberland Counties than in Richmond and Westmoreland Counties. Lancaster’s senior population is 36.7% of the total and Northumberland’s proportion is 37.5%, both of which have increased since the 2010 census. In Richmond and Westmoreland, seniors comprise 21.1% and 26.5% of the population, respectively, which have also increased in the last 10 years. As a region, the senior proportion is 29.5% of the population. By comparison, the state’s senior population as a percentage of the total is 15.9%.

SUMMARY BACKGROUND

PURPOSE AND BACKGROUND INFORMATION

This Comprehensive Economic Development Strategy (CEDS) allows the Northern Neck Economic Development Planning District Commission (NNPDC) to apply for assistance from the Economic Development Administration (EDA) under the Economic Development Administration Reform Act of 1998.

Economic development planning has been a key element in achieving EDA’s long-term goals since the original Public Works and Economic Development Act was enacted in 1965. The Overall Economic Development Program process was what made EDA a truly effective federal/local partnership, resulting in the creation of over 320 Economic Development Districts (EDD) around the country.

EDDs play a key role in local economic development. Instead of having to respond to individual requests from the over 2,000 eligible county economic development organizations around the nation, EDDs assist the EDA in establishing regional priorities for projects and investments.

The EDD for the Northern Neck region is the Northern Neck Planning District Commission, which was designated an Economic Development District by the U.S. Department of Commerce, Economic Development Administration, in February 1999.

This CEDS document was put together with the active participation of members of the Northern Neck Planning District Commission, the Northern Neck Chesapeake Bay Region Partnership, and the Northern Neck Tourism Commission, in partnership with Northern Neck localities and other stakeholders.

Northern Neck Regional Vision

For the development of the region’s Stronger Economies Together (SET) study, over 40 local leaders invested 3 months in clarifying the region’s values and discussing its future. After several drafts, the full group of stakeholders applauded a vision statement that represents its diverse values, its heritage, and its focus on balanced economic growth. The adopted vision statement is:

The Northern Neck is a vibrant, skilled, and diverse rural community that sustains a

well-balanced, growing economy which benefits from and values its heritage and natural resources.

Northern Neck CEDS History

First CEDS adopted on July 17, 2000

Revised CEDS adopted on April 29, 2002

Revised CEDS adopted on September 2, 2003

Revised CEDS adopted on October 18, 2010

Revised CEDS adopted on April 22, 2013

Revised CEDS adopted on April 16, 2018

Revised CEDS adopted on January 24, 2022

This document was prepared with funding from the:

U.S. Department of Commerce Economic Development Administration

Curtis Center, Suite 140 South

601 Walnut Street

Philadelphia, PA 19106-3821

215.597.7883

www.eda.gov

This study was conducted under the auspices of the Northern Neck Planning District Commission

Jerry W. Davis, AICP, Executive Director

P.O. Box 1600

Warsaw, Virginia 22572

804.333.1900

Production Team for this CEDS edition:

Research and text: Grella Partnership Strategies

Administration: Jerry W. Davis, AICP, Executive Director, NNPDC

Production: Lisa Hull, Economic Development and Tourism Coordinator, NNPDC

Data Sources

- U.S. Census Bureau Washington, D.C. (2020 Census)

- County Business Patterns, of the U.S. Census Bureau

- U.S. Bureau of Labor Statistics (2021 Data)

- StateBook.com

- Surfrider Foundation (surfrider.org)

- Polyindustries.com (Polyindsutries.com)

- DATAUSA.io, a service of Deloitte

- Northern Neck Comprehensive Economic Development Strategy 2018, Northern Neck Planning District Commission and the Virginia Tech Office of Economic Development

- Northern Neck Regional Water Supply Plan by EEE Consulting, funded by Virginia Department of Environmental Quality and the Counties of the Northern Neck 2009

- Northern Neck Regional Hazard Mitigation Plan by Federal Emergency Management Agency, Virginia Department of Emergency Management and Dewberry, 2017 Update

- Stronger Economies Together (SET) 2013 to 2018 by USDA and Regional Rural Development Centers

- Northern Neck Corridor Improvement Study by Virginia Department of Transportation, 2014

- Strategic Tourism Plan for the Northern Neck of Virginia: 2019 to 2023, Dr. Vincent Magnini, Virginia Tech

- Coastal Virginia Small Business Resilience Self-Assessment and Guide developed by the Old Dominion University Institute for Coastal Adaptation and Resilience

- Subsector Insights and Recommendations, a report for the Virginia Economic Development Partnership by Boston Consulting Group, August 2021

- The National Park Service

- The State of the South (several editions), produced by MDC, covering the period from 1996 to 2017

THE 2022 NORTHERN NECK CEDS UPDATE

The Northern Neck is a destination for second-home owners and tourists. It hosts an active aquaculture industry, features a diverse economy that includes small manufacturers and successful timber companies, and has become increasingly attractive to professionals, who are able to work remotely and value the quality of life offered in the Northern Neck, with little traffic congestion, clean air and water, and low population density.

With all these positive quality of life fundamentals making the Northern Neck attractive to travelers and businesses alike, the following areas of concern need to be addressed to maintain and grow the regional economy:

- populations are projected to grow only slightly in Westmoreland County and Richmond County

- median incomes are lower than state and national figures

- poverty levels have increased

- limited water, commercial sites, infrastructure, and skilled labor have set constraints on the region’s economy

POPULATION

Since the 2010 census, population has declined in Lancaster, Northumberland, and Richmond Counties and grown by almost 6% in Westmoreland County. The Northern Neck’s median age is 53, and Lancaster and Northumberland Counties have seen their median ages rise to nearly 60 years old.

INCOME

Median household income is behind the state level in all four counties. Lancaster County gets closest to a the national level.

Source: https://data.census.gov/all?q=2010+Median+Household+Income+Virginia

EMPLOYMENT

Lower employment rates in the region correlate to the higher population age in Lancaster and Northumberland Counties, and are also attributed to the incarcerated population in Richmond County at the Haynesville Correctional Facility that houses approximately 1,141 inmates.

POVERTY

The poverty rates are in double digits for every county, ranging from 10.3% of the population in Lancaster County to 16% in Richmond County, averaging 12.9% for the region. Again, the high rate of poverty in Richmond County correlates to the low workforce participation rate and the fact that Richmond County hosts two correctional facilities.

Source: www.statsamerica.org

DEMOGRAPHIC / SOCIOECONOMIC

INCOME

WORKFORCE CHARACTERISTICS

UNEMPLOYMENT

EDUCATION

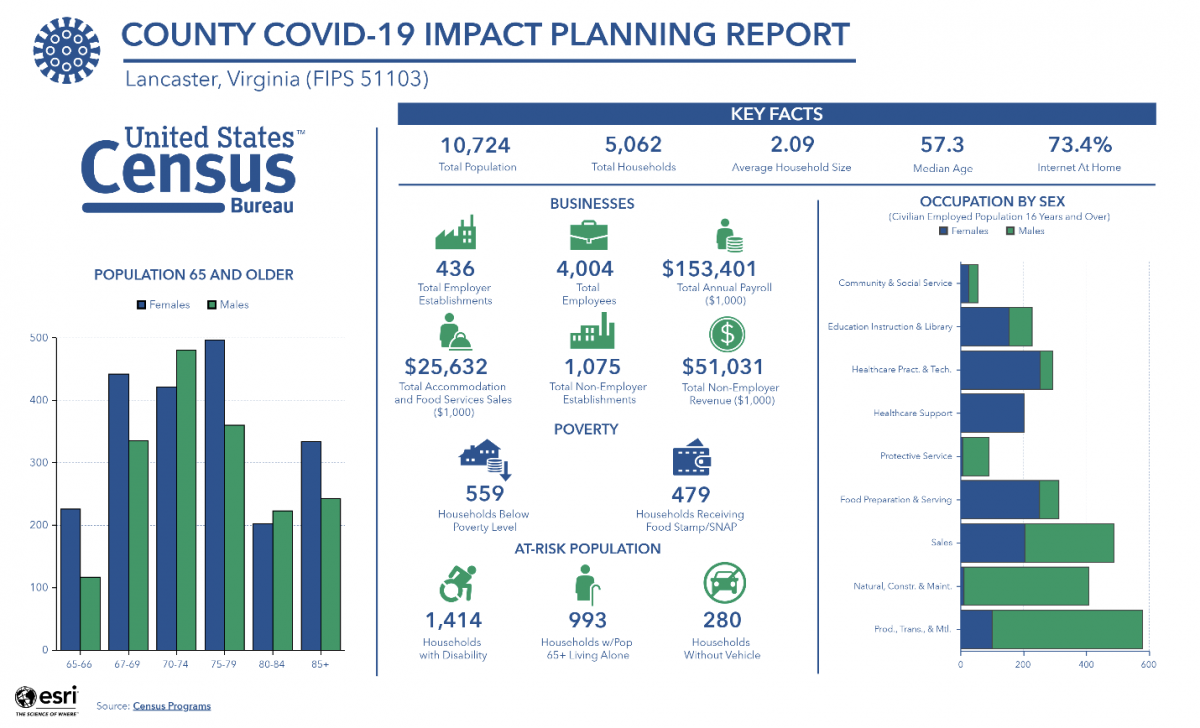

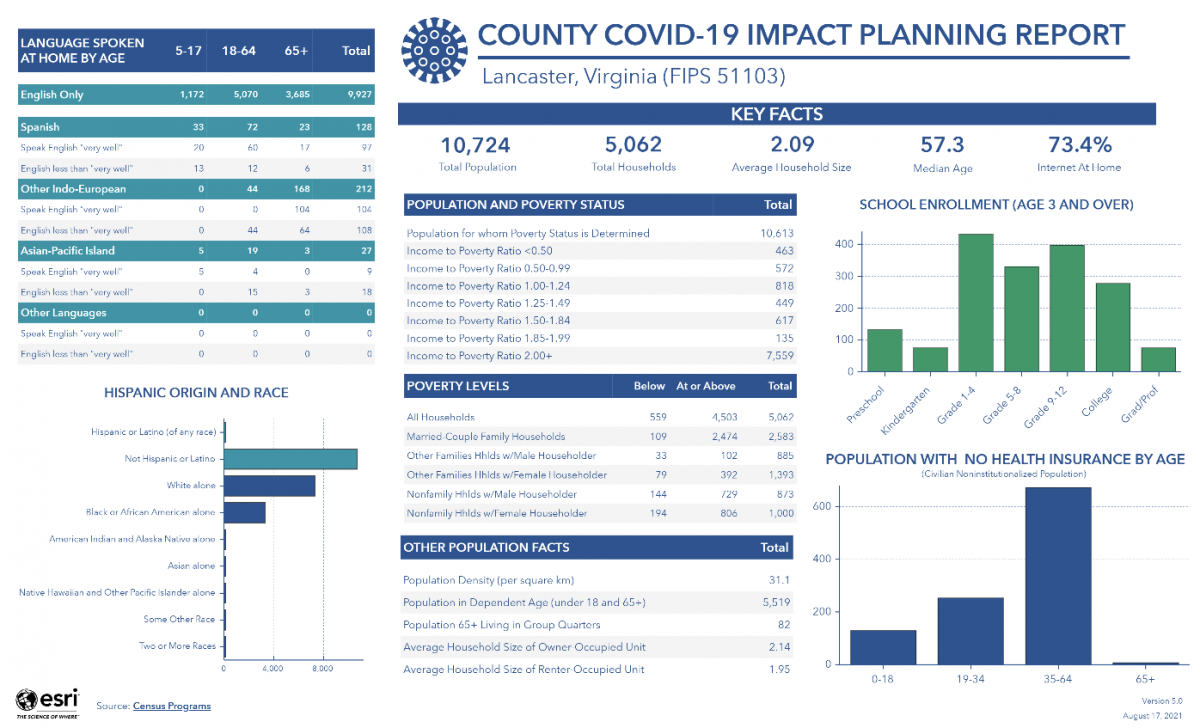

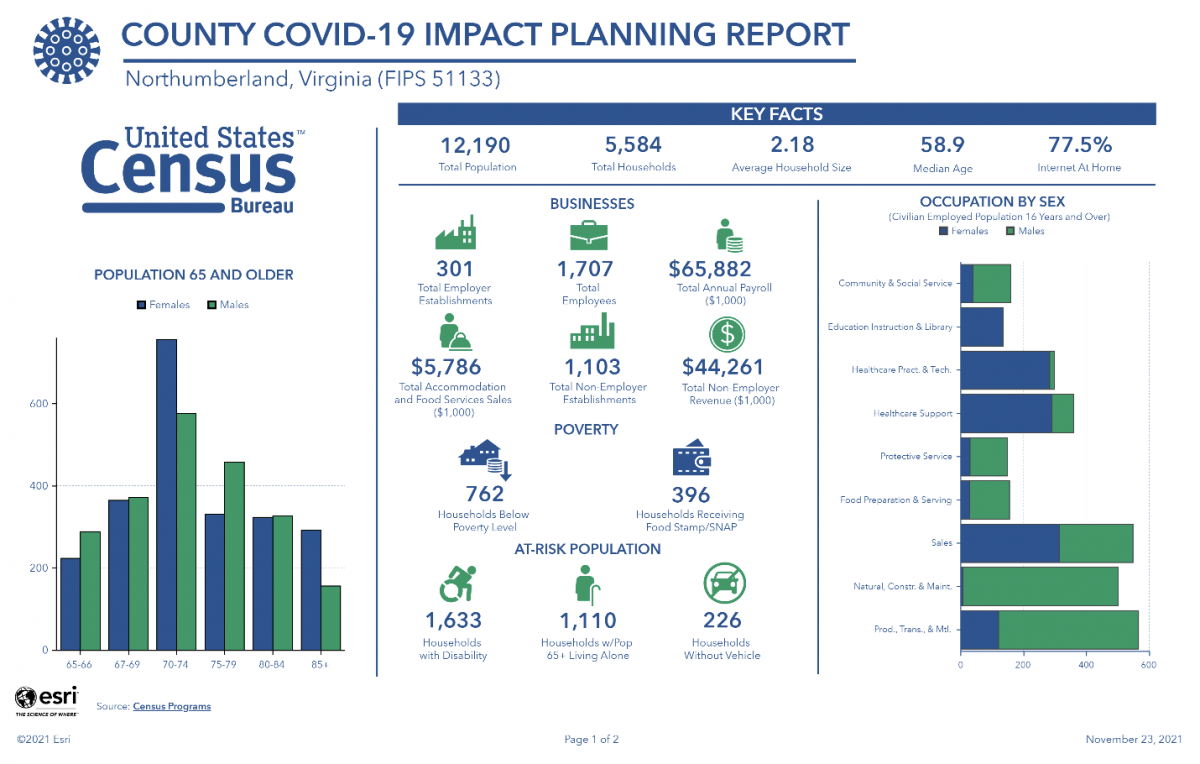

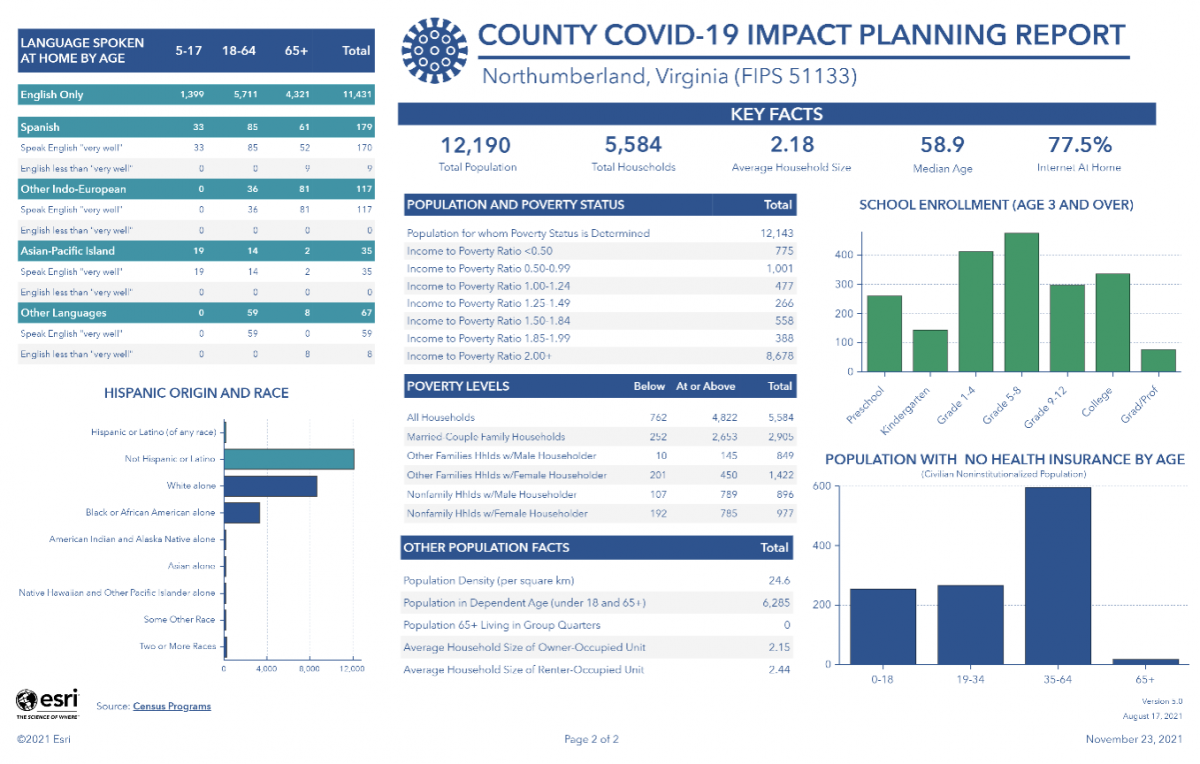

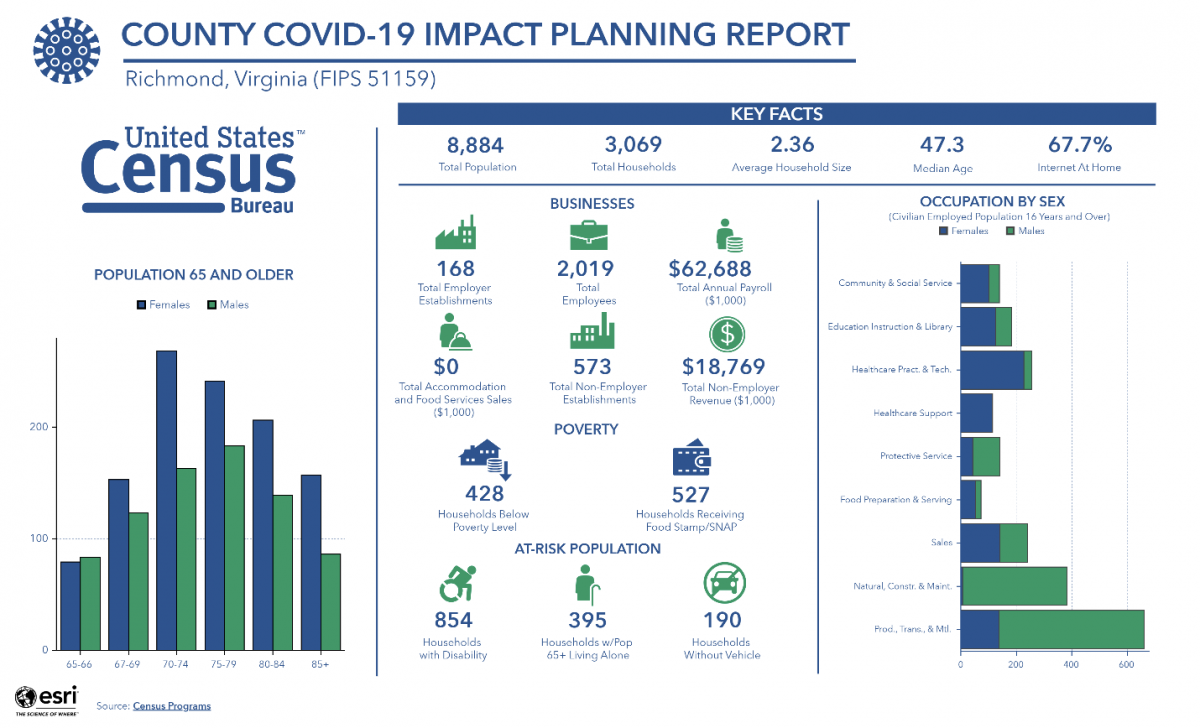

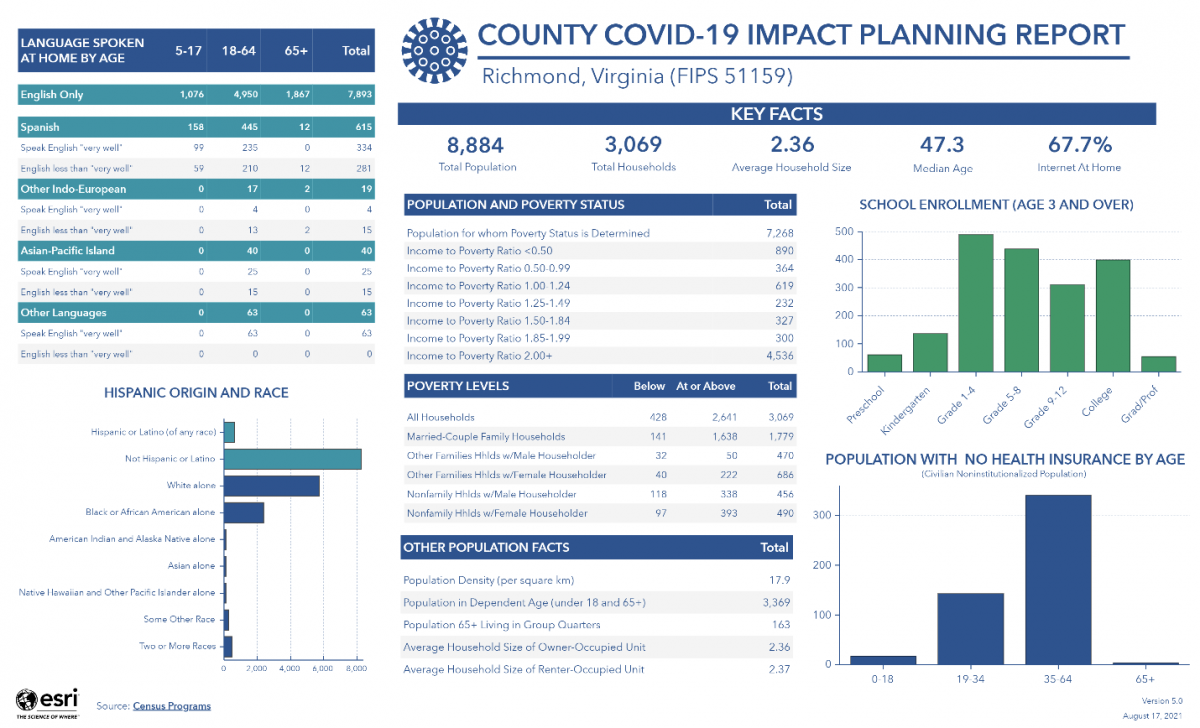

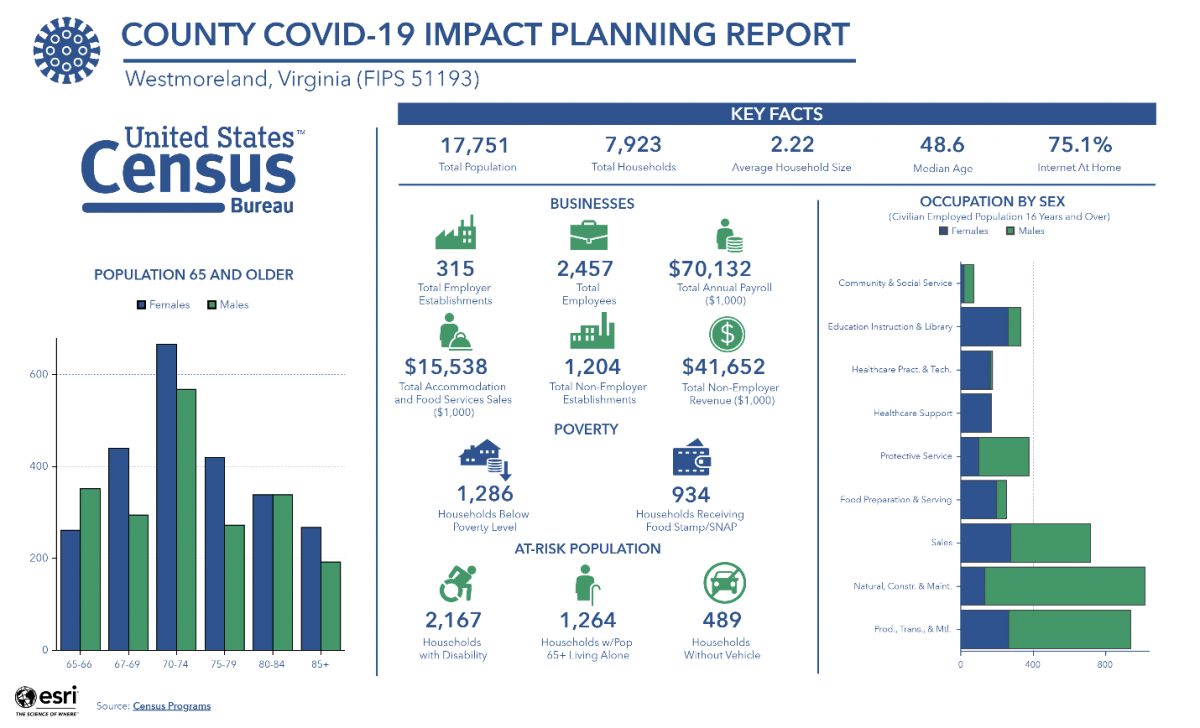

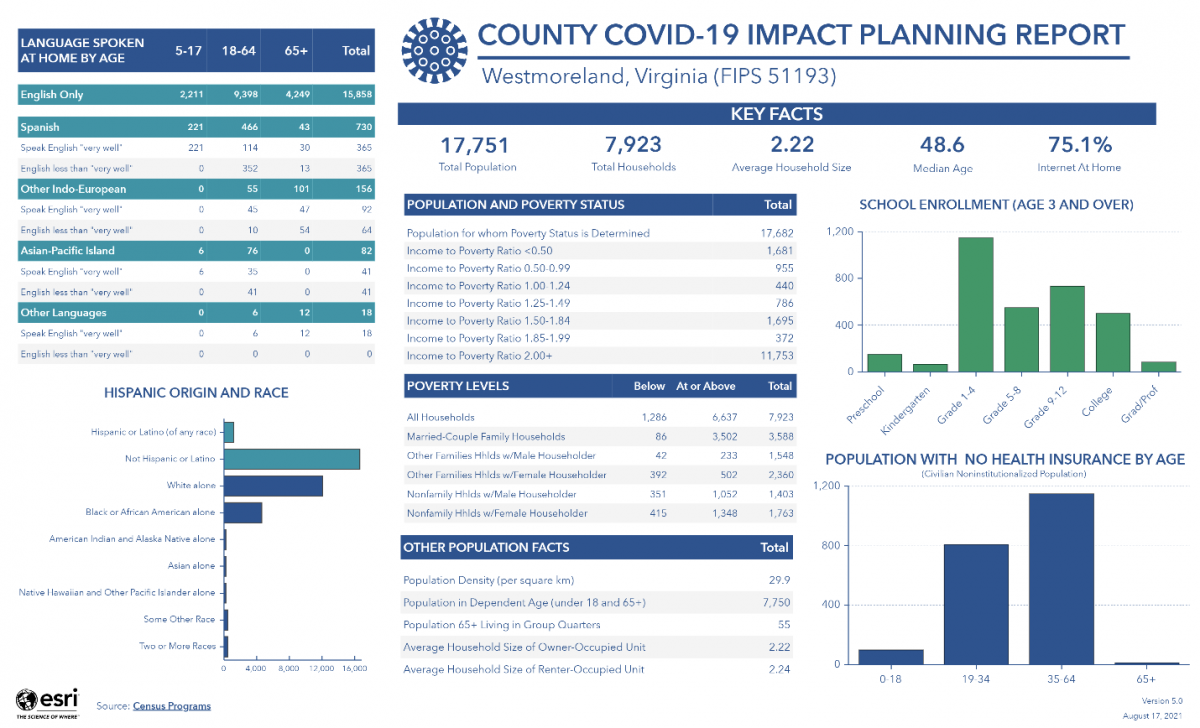

COVID-19 IMPACT

Data provided by the U.S. Census for each of our Counties.

STRENGTHS, WEAKNESSES, OPPORTUNITIES, THREATS

SWOT ANALYSIS

Strengths and Weaknesses tend to be internal factors while the Opportunities and Threats tend to be external.

STRENGTHS

- Quality of life

- Natural beauty

- History

- Boat building hub

- Water-based resources and agricultural-based assets, such as new or unique crops and products

- Tourism (Ecotourism, Wine Trail, water sports)

- Local seafood

- Specialty foods made locally

- Geographic proximity to DC, Richmond, and Tidewater

- Influx of new residents as an effect of the pandemic

- Rappahannock Community College

- Northern Neck Technical Center and Governor’s STEM Academy for Agriculture and Maritime Studies

- Effective Workforce Development Board

- Broadband about to expand to cover the region

- Strong regional organization (NNPDC)

- Thriving small towns with dining and retail

- Unique lodging, including a resort and bed & breakfasts

- National Heritage Area Designation progress

- Active Enterprise Zone Program

WEAKNESSES

- Infrastructure – highway & bridges aging, failing, and/or in disrepair

- Regional workforce needs to grow and to continue expanding skills

- Limited public transit

- Affordable housing – commute for most workers is 40-45 minutes

- Water access – Few places to access the water

- Few restaurants or shops on the water

- Public school system – needs upgrade

- Exodus of youth

- In-migration of senior citizens and retirees, but not enough workforce-aged people

- Manufacturing base is small

- Low industrial building/site inventory

- More services could be added, such as shopping, healthcare facilities, lodging

OPPORTUNITIES

- Remote Work/Work from Home will create proximity to distant metro areas

- Enhanced communications will create increase in demand-driven training

- Attract & retain workers

- Expanded Tourism Marketing to more distant and new markets to boost tourism

- Develop more opportunities for Adventure Sports/Outdoor activities (e.g., zip lines)

- Enhanced recreation – at Belle Isle and Westmoreland State Parks (awareness, programming); the new Compass Entertainment Complex; development of the Tri-Way Trail)

- Specialty/Niche Tourism – sport fishing, ecotourism, arts/culture, history

- Proximity to Dahlgren Naval Base with small business opportunities

- Mentoring and other input from new resident retirees with business experience

- Specialty agriculture/farming – showcase farms; value-added products (not just raw materials); specialty foods made locally

- Boat building/restoration & repair/storage

- Grow County economic development staff

- Digital Marketplace for local products

- Boost entrepreneurship (Incubator, co-working space)

- Business assistance, such as SCORE

- Small business training in social media, website development, e-commerce, marketing, design

- Attracting additional companies in industries like Engineered Wood Products and Warehousing/Logistics

- Affordable housing for teachers and working class; more multi-family residences closer to or in town

- Enhanced capacity of the Northern Neck Loan Program, and town revolving loan programs

- VA Clean Economy Act of 2000 – solar farms, “Solar for Schools” program, renewable energy training

- Guide to starting a business – easy and user friendly

- HUBZone designation for all counties until 12/31/2023

THREATS

- Decline of water availability and quality due to levels declining and salinity rising

- Aging septic systems

- Frequent flooding

- Reliance on seasonal agricultural workers

- Need more food processing facilities

- Protecting legacy of the “Working Waterfront”

- Shortage of hotel rooms and the inability to handle bus tours

- Environmental regulation

- Competition between commercial fishing industry & sports fishing

- Health Care – lack of specialty care for older residents causes an exodus to areas with more comprehensive health care

- Reduced sales tax capture – folks working elsewhere do most of their transactions (groceries, financial, etc.) outside the county

- Location makes the Northern Neck communities susceptible to natural disasters and hazards

OPPORTUNITIES AND THREATS

While there are a number of opportunities that are worth pursuing, several stand out for prioritization.

REMOTE WORK

An outgrowth of the pandemic is the rising popularity of remote work. For twenty years, the growth of relatively remote communities has been spurred by entrepreneurs escaping from the big cities to run their businesses via computer and cell phone.

As this way of doing business gains traction among more companies large and small, the opportunities expand exponentially for workers in more rural communities that may have low visibility but offer a high quality of life. These communities have seen an influx of people and businesses who find they can function effectively in beautiful places, far from the hustle and bustle of big cities.

The Northern Neck boasts a natural beauty, quality of life and a palpable warmth that has attracted people from all over the east coast both before, and especially during the pandemic.

The Northern Neck’s remote work/unique value proposition is the combination of its mid-Atlantic waterfront location and its relatively close proximity to Washington, DC, Richmond, and Norfolk—now soon to be augmented by an increasing quality and availability of broadband. These factors create a competitive advantage for the region.

Expanding options for remote work influence the local economic environment via the ability to attract more businesses that are now comfortable conducting their affairs online, and the ability to offer remote workers an expanded area in which they can settle in the region.

This evolution in doing business is attractive to workers and offers an expanded palette of job opportunities for those already living in the region.

This may encourage more young people to remain in the Northern Neck after graduating from school, and may bring back former residents and alumni to raise their families in the region they once called home. It also reduces the potential disadvantages to newly locating workers and families, who now may be able to keep their jobs or find new ones anywhere in the world.

WORKFORCE DEVELOPMENT

Workforce Limitations

There exists a double opportunity/threat posed by limitations on available workforce. Three out of every four businesses interviewed noted that a lack of skilled workers was a major constraint to their growth. Companies in various industries such as timber, manufacturing, tourism, and aquaculture were ready to expand, but were unable to find a sufficient workforce.

Respondents shared one of two schools of thought in this regard: some felt that there was just a scarcity of people with the skills needed in their industry, while others observed a shortage of workforce in general. With populations that are relatively stagnant or shrinking, the challenge is to enhance the skills of the existing workforce to meet the needs of local employers.

Business owners and managers cited a lack of people with the skills to run sawmill saws, work on diesel engines, or a lack of basic computer skills. As part of a companion project that reviewed the workforce pipeline, numerous interviews were conducted with Rappahannock Community College (RCC) leaders, other trainers, workforce development officials and employers.

Positions requiring a variety of skill sets were identified as needed but largely unfilled at businesses in the region. However, most of those skills were included in the course curricula at RCC. It became apparent that by increasing communication between employers and trainers, the existing workforce in the area could be optimized. Recently, several new approaches were initiated to increase coordination and cooperation between employers with available jobs and workforce training professionals. These efforts should be helpful in preparing young workers for real jobs, as well as for reskilling or upskilling workers who lost their jobs during the pandemic.

However, increasing communication and improving training opportunities will likely not be enough to satisfy the needs of frustrated business owners who feel that the workforce will still be too small to meet their needs. To retain, expand and attract businesses to the Northern Neck, it will be essential to create and implement a strong strategy to attract new people to the region and to reclaim workers who left the region.

Workforce, despite the current shortages, is also a topic loaded with possibilities. Remote work may offer new opportunities for high paying jobs from outside the region to be available to Northern Neck working residents and could sweeten the “quality of life” incentive, drawing more workers and their families to the Northern Neck. However, there is much more that can be done to optimize the existing workforce while ensuring that employer needs are met.

The Role of Workforce Education and Training

The existence of multiple locations for Rappahannock Community College at sites in Gloucester, Richmond, Lancaster, King George, and New Kent Counties presents a tremendous resource for economic development. The college offers programs that address needs in the manufacturing, aquaculture, timber, tourism, and other industries native to the Northern Neck, and is in the process of diversifying its course offerings. Addressing the issue of skilled worker shortages more effectively will create an opportunity to fuel growth in the regional economy.

The Role of Communication

There is a high level of commitment by RCC to meeting community needs and serving the employers of the region, with whom gainful employment could be found for RCC graduates. Most encouraging is the fact that every employer interviewed who had any experience working with RCC gave the college very high marks in meeting their employment needs. What seemed most limiting to RCC’s ability to train students for jobs in the region appeared to be a lack of ongoing communication with employers regarding their needs.

Many employers did not realize that the college was already training students in the job skills they needed to hire and maintain their workforce. No blame was placed either on the college or on the employers, but, clearly, there is a need to promote closer and more routine communication between trainers and employers. Where appropriate training exists, employers may find real prospects for hiring and where that training might not yet exist, the leaders of RCC are eager to find ways to meet the needs of those employers, as feasible.

The Bay Consortium Workforce Development Board, which serves as the regional Workforce Development Board (WDB), working in conjunction with the Northern Neck Planning District Commission (NNPDC), has recently taken on two ways of bringing employers and trainers (including RCC) together. The WDB has a monthly Business Services meeting that is well attended by RCC and other training groups in the region, and has launched a campaign to attract employers to attend and hear what is available, and to make their needs more widely known.

This monthly venue has been supplemented by a series of industry roundtables conducted in 2021, hosted by the WDB, and co-hosted by the NNPDC. Each roundtable featured presentations by local employers, followed by discussion with RCC representatives and economic developers. In-person/Zoom hybrid industry roundtables were held for tourism, aquaculture/agriculture, marine industries/marinas, healthcare, technology firms, and manufacturing. The dialog was most enlightening and several of the attending businesses are already collaborating more closely with RCC.

List of Key Industries in the Northern Neck /need for skilled workers

- Aquaculture

- Agriculture

- Marina Management

- Manufacturing

- Timber and Wood Products

- Tourism and Hospitality

- Construction Trades

- Nursing

- Food Processing

- IT and Cybersecurity

- Research and Development

- CDL

We predict that matching of trained workers with employers’ needs will ramp up soon and, as RCC graduates find employment, word will spread that relevant coursework can help individuals find a good job. In the past, the lack of an obvious close connection between training and employment has sometimes led to needed courses failing to generate sufficient enrollment to continue offering them. By creating more awareness, there is an opportunity to optimize workforce resources, help employers thrive and grow, and attract more young people back into the region’s workforce.

That brings us to the other aspect of workforce challenges: the lack of enough people of working age to build an adequate workforce to meet business needs.

Workforce Growth

The quality of life in the Northern Neck currently attracts those who want to relocate from area cities to the region. In addition, the Northern Neck needs more working-age individuals to fill the workforce gaps and reduce the average age of the overall population. The region has a rich offering for families and workers, but it will require an aggressive promotional effort to get the word out and to incentivize workers to relocate to the region. One idea would be to model a campaign like what has been accomplished in other small communities all over the country—creating and implementing a regional “come back home” campaign targeting emigrating young people. Incentives such as cash payments, payment of moving costs, assistance with finding and purchasing homes, and help with finding jobs for spouses may be considered to help encourage this return home.

It will be important for the Northern Neck to find ways to retain and attract workers to supplement the workforce numbers. Once again, this can be turned into an opportunity if action is taken. The growth of local firms, their willingness to train and promote workers, and the lure of rejoining family and friends can be a strong pull for former residents, as well as an attractive package. However, it is important for the Northern Neck to expand its available workforce if businesses are to grow and remain viable in the region.

HAZARD MITIGATION

One possible deterrent to people locating or relocating to the Northern Neck could be the susceptibility of a region surrounded on three sides by water to flooding and other natural disasters. The Northern Neck Hazard Mitigation Plan, updated in 2017, lists several natural threats, mostly tied to weather. These included flooding, hurricanes, tornadoes, coastal erosion, winter storms, drought, wildfires, and earthquakes.

In their revised plan for 2017-2020, the federal emergency management agency (FEMA) and the Virginia Department of Emergency Management recommended several approaches to ameliorate the impact of these natural threats, including land acquisition, floodplain protection, watershed management, beach and dune preservation, riparian buffers, forest and vegetation management, erosion and sediment control, wetland preservation and restoration, habitat preservation, slope stabilization, and the protection of historic and archaeological sites.

The report cited the importance of the Northern Neck’s assets to industry and tourism, suggesting an aggressive program of education, infrastructure development, and hazard awareness.

TOURISM

Tourism has been an important contributor to the regional economy and continues to be an area with great potential. Unfortunately, this industry, while stable, has also been relatively flat. With the natural and human resources available in the Northern Neck, prior to the pandemic, travel and tourism seemed likely to have been growing. However, the industry, which includes accommodations, recreation, and food services, has shown minimal growth in the three years leading up to the COVID-19 crisis. It has also lagged behind state growth data in tourism-related expenditures, payroll, employment, taxes collected, and the overall number of tourism-related businesses.

These data did not surprise most of the tourism industry people who were interviewed, and they almost unanimously believe that there is room for improvement. Factors that may be limiting optimization of this essential industry include shortages of workers, somewhat limited access to the region, relatively scarce access to the waterfront, a shortage of available accommodations, and relatively little budget for regional marketing.

In the Regional Tourism Plan (2019 to 2023) provided by the Northern Neck Tourism Commission, visits by tourists and travelers proved to be a popular and viable way to grow the local economy. It was found that tourists tend to come to the region more than once per year, that roughly half of them have six-figure incomes, and that they tend to prefer extended stays.

However, more product development and marketing are cited as necessary to optimize this resource. More hotel rooms were cited as a need, as were the need for a consistent brand, regional cooperation, more water-access infrastructure upgrades, and more marketing dollars spent on tourism.

The region is looking to the development of Longwood University’s Hull Springs Farm as a conference-center destination that could accommodate small groups and provide a location for a commercial kitchen and culinary-arts training. Expanding the footprint of a four-year university in the region will stimulate research crosswalks between K-12 students, especially the Chesapeake Bay Governor’s School, and generate local internships in marine and environmental studies.

WATER ACCESS

Given that the Northern Neck is surrounded by water (Chesapeake Bay, and the Potomac and Rappahannock Rivers), lack of public access to the water is driven by private waterfront acquisition for homes, and steadily rising prices of waterfront property. The counties should be encouraged to increase and enhance public waterfront amenities, as 47% of residents see public water access as one of the area’s ‘Most-Needed Outdoor Recreation Opportunities’, according to the 2018 Virginia Outdoors Plan. The NNPDC has joined with other coastal PDCs in an effort to promote water trails around the Chesapeake Bay and its tributaries for paddling through a website: virginiawatertrails.org.

NATIONAL HERITAGE AREA DESIGNATION

One reason for optimism about recovery and growth for tourism in the region is the recent Congressional action on designating the region as a National Heritage Area. In June, companion bills were introduced in the House and Senate that would finalize the designation of the Northern Neck as the Northern Neck National Heritage Area and would be a major asset to the region. Prospects are good for passage in both houses, with bipartisan support at the point of introduction. A feasibility study conducted by the National Park Service qualified the region as a national heritage site; Congressional passage is the last step in the process.

According to a press release dated June 24, 2021, Senator Mark R. Warner announced that the Northern Neck National Heritage Area Act “…would deliver critical federal dollars, encourage public-private partnerships and assign…The Northern Neck Tourism Commission…to help protect the Northern Neck’s natural, cultural, scenic, and recreational resources.”

The counties included in this designation would be Westmoreland, Richmond, Northumberland, and Lancaster counties along with King George County. Given its beauty and historic importance, the Northern Neck should be able to showcase its assets and “…bring visitors and economic development…” to the region. The opportunity to expand the influx of visitors to the Northern Neck and to support the growth and numbers of tourist accommodations in the area could be enormous.

The effort to attain this designation has been twenty years in the making.

AQUACULTURE / AGRICULTURE

Another key industry to the Northern Neck, aquaculture, also has opportunities to grow if certain factors can be addressed. The industry, which includes busy oyster beds that provide a major source of oysters throughout the region and beyond, a successful large manufacturer of fish proteins, commercial fishing, thriving marinas, and more, has been somewhat limited by various constraints, including limitations on shipping due to a scarcity of refrigerated truck companies, reliance on temporary workers from outside the region and a shortage of food processing and cold storage facilities.

Aquaculture and agriculture offer opportunities for economic growth in the Northern Neck. The widespread presence of these industries and the varied nature of products available make them candidates for expansion. A food hub, refrigerated trucks for delivery to markets, a food incubator, more cold storage and improvements to roads and bridges to ease deliveries outside the region, a community commercial kitchen and a food coop are all suggested opportunities to grow in the area of aqua/agribusiness. Aquaculture needs more trained workers and both industries rely heavily on temporary workers from outside the country. Training and higher wages could be helpful in growing both of these important local industries.

CONSTRUCTION AND MANUFACTURING

Construction has experienced greatly increased demand thanks to people relocating during the pandemic. However, the industry has been held back by a lack of skilled workers and the number of affordable tools for young apprentices. Manufacturing, which features several medium sized and growing companies, could expand if it could access more skilled workers, who might be more attracted to the region if there was more availability of affordable housing. Ironically, the very boom in retirees coming to the Northern Neck has further boosted housing prices, meaning that for many workers there are fewer and fewer attractive single-family homes or multi-family developments.

WATER SUPPLY

Clearly, several of the region’s most frustrating constraints can be turned into opportunities. For example, the declining water supply can be supplemented by exploring alternatives to groundwater. Alternatives could include reverse osmosis desalinization, or the use of harvested rainwater for both cooling and potable water. Harvested rainwater is one of the oldest technologies for non-potable water, although the technology has advanced to make the process more cost-efficient. Untreated rainwater can be used as “gray” water in effect, which can be used for non-potable purposes such as cooling servers in a datacenter.

A big change has come in the advances for various filters and the use of UV lights to sanitize the water. State health authorities are beginning to clear harvested rainwater for uses beyond toilets and washing machines; now cleared for use in Virginia as potable water in homes and commercial entities. Homes are being built using rainwater as a primary source of water, with cisterns being set up to hold reserves in case of drought. The use of harvested rainwater for drinking water, only permitted in Virginia in the last 3-4 years, has cleared a major hurdle in making this an important source of water.

Rainwater is easily captured using a level, flat roof. Recent estimates by the Surfrider Foundation (surfrider.org) are that 620 gallons of water are generated for every 1000 square feet of rooftop or other flat collection surface base on every inch of rain that falls. Pipes carry the water forward to filtration and a cistern is built to hold emergency water. This can revolutionize a development program by allowing housing and commercial development in places that lack adequate groundwater. It also represents an entrepreneurial opportunity for those who understand the technology and can service homebuilders and businesses in places like the Northern Neck where both residential and commercial opportunities may soon be constricted by the decline of the local aquifers. Incentives and technical assistance for such companies and entrepreneurs might help amplify available water for development and create a cluster of technology companies that could flourish in a region that represents a ready market for that technology.

Despite the growing potential for harvesting rainwater, there are further limitations that need to be addressed. A report funded by the local governments and the Virginia Department of Environmental Quality issued in September 2009 had already expressed concerns about the status of the regional water supply. The report cited the fact that most local use of water was limited to groundwater and noted that large amounts of rainwater are trapped by vegetation in the region and evaporate. Thus, considerably more flat rooftops would have to be constructed to capture more rainwater.

Given the fact that a handful of large users are reducing the level of the aquifers in the region and that salinity is a creeping challenge, alternate sources of water, especially potable water, need to be sought. However, the report also warns that adjusting to create more potable water can also upset the ecological balance and create challenges to the local salt waters that support local fishermen and food processing plants. The report suggests that all economic development projects consider the water demands that will be generated by those projects.

SMALL BUSINESS SUPPORT

Direct assistance to small businesses in general could only help amplify the impact these companies have on the regional economy. The region has a short supply of resources that can provide direct help to businesses with operations, marketing, finances, HR issues, digital transformation, and other routine operations. The four counties lack the resources to hire full time economic development staff or to build departments or mount major business support programs. University of Mary Washington hosts a Small Business Development Center (SBDC), which serves Northern Neck businesses, and has instituted entrepreneurship programming in the high schools. The SBDC offers business counseling and assistance with development of business plans. Rappahannock Community College has several business and management courses that could be helpful, but small business owners are busy trying to stay alive and grow their companies, which has become even harder, given the impact of the pandemic and the labor shortages that have followed. The Northern Neck Loan Program is active and recapitalized as of July 2021 and offers low interest loans to local small businesses (northernneck.us/access-to-capital).

BUSINESS PARKS AND COMMERCIAL PROPERTY DEVELOPMENT

The ability to grow the economic base is also limited by the shortage of “shovel ready” business parks and commercial properties. The NNPDC has identified some potential sites, and if adequate infrastructure is either present or can be provided, the Northern Neck has an opportunity to attract companies in light manufacturing, warehousing and distribution, food processing, wood products, travel services, and possibly datacenters. This ability to amplify and diversify the business community can provide and attract more resources, more workers, more capital, and more financial resources for the communities.

It is suggested that the Northern Neck seek grant funding to assess selected sites as to the infrastructure, utilities and financing needed to locate new and expanding businesses. Then, to accompany that study, a branding and marketing campaign could be developed that would target appropriate industries to locate in the Northern Neck. This is another opportunity to turn a challenge into a benefit.

Transportation limitations are cited as one of the infrastructure deficiencies that may be holding back development in the region. Narrow roads and bridges in need of repair make it harder for companies to ship products to market, receive supplies and attract workers. One of the main roadways that connects both ends of the region, State Route 3, is narrow and slow to traverse in spots. Proposals to widen the road to four lanes all the way to the Norris Bridge were deemed too expensive by VDOT, but the addition of more passing lanes in busy stretches of the highway may provide some relief.

Moreover, at least one of the three main bridges needs shoring up in the short run and replacement in the long run.

Some of these findings were already cited in a 2014 report focusing on Route 3, the Northern Neck Corridor Impact Study, conducted by the Virginia Department of Transportation. Interestingly, the report also cites the increasingly older nature of the regional population. With people over 65 already higher than the State average, and many of the new people coming in being retirees, not workers.

BROADBAND

Broadband, which was a major inhibitor of economic growth has, with the award of a grant from the State, become an opportunity for fostering growth and development. A unique partnership between the State, Dominion Energy Virginia, All Points Broadband, and Northern Neck Electric Cooperative will move on the first phase of this ambitious project. It is expected that the first phase will bring fiber-optic broadband access to roughly 7,200 currently unserved households and businesses in the Northern Neck.

This first phase will take advantage of a $10 million grant from the State, augmented by federal and local funds plus private investment, to deliver internet access to the balance of unserved locations in the Northern Neck, including King George County.

Without universal broadband/high speed internet, companies cannot expand, will not locate and employees will not want to live in the Northern Neck. The new funding is expected to allow the Northern Neck communities to address the need for universal broadband throughout the region. The current plan will facilitate the established goal of universal coverage for the entire Northern Neck, which, when achieved, should be well-publicized and leveraged to market the Northern Neck as a “remote work” location.

ENTREPRENEURSHIP

Entrepreneurship is a viable avenue for the Northern Neck to pursue. The ability to generate new businesses is a sound component of a healthy local economy and the region has several industries that hold potential for doing so. In aquaculture, agriculture, timber, manufacturing, construction, healthcare, personal services and tourism, the region boasts several industries where upward mobility for the workforce could include opportunities for spinoff companies.

When a community puts a premium on entrepreneurship and innovation it can serve to keep some of the young entrepreneurs in the region and offer a career path that they might not otherwise have considered. The time is right, in that RCC is looking to include basic entrepreneurship into some of their courses on particular industries and occupations. In addition, a key source of funding for economic development projects and programs in Virginia, GO VA, has made entrepreneurship an important part of the program, helping to seed entrepreneurship ecosystems statewide and in the sub-regions.

Communities also find that creating a supportive environment for entrepreneurship can work as a powerful incentive for attracting new industry. The college offers a fine place to start, in terms of its ability to reach young people, and existing courses that can accommodate at least

an introduction to entrepreneurship. However, the Northern Neck and its member counties should also consider supporting other ways of spurring entrepreneurship such as creating/facilitating co-working centers and incubator/accelerators. GO VA funding could be sought by the NNPDC, individual counties and RCC to augment resources that can encourage and support new business startups.

MILITARY PROCUREMENT OPPORTUNITIES

The proximity to Dahlgren Naval Base also offers opportunities for companies in the Northern Neck. The Naval Surface Warfare Center, Dahlgren Division has played an increasingly important role in development of vehicles central to U.S. Naval operations. There are numerous contract awards and set asides for technical firms that meet the criteria for federal small business set asides. The NNPDC works and meets with Dahlgren on a regular basis, but there are always more opportunities to tune local firms into business available on the base. The designation of all the counties in the Northern Neck as HUBZones until 12/31/2023 supports this opportunity.

ATTRACTING ADDITIONAL COMPANIES

Given the strong appeal of the quality of life, the access to major population centers and urban markets, the presence of Rappahannock Community College and the health of local towns, the Northern Neck does have appeal as a magnet to attract industry. Local businesses are largely happy with their environment and the NNPDC serves as an effective regional development facilitator, which sets the stage for successful business attraction.

The Northern Neck’s Stronger Economies Together (SET) study (2013-2018) looked at integrating regional differences and industry clusters in order to maximize the competitive advantages of emerging industries, which have been gradually replacing declining sectors of the Northern Neck economy.

Close geographic proximity and engagement in similar or related economic activities are the key

factors leading to the development of clusters. The study identified a Water-Based Cluster that includes synergies between tourism (historic sites, wineries, heritage trails, events), agri-aqua business (oyster hatcheries, forestry, farming), large value-added production from local natural resources, and recreation (sports fishing, water sports, tours and cruises, heritage trails, hotels and resorts).

Another recent study commissioned by the Virginia Economic Development Partnership and conducted by Boston Consulting Group (BCG) identified prospects at the “sub-industry” level that may be interested in various regions of Virginia. The BCG report focused on several opportunities to attract investment in the Northern Neck region, with the two most likely being Warehousing/Logistics and Engineered Wood Products. They cited access to transportation, available sites, and a ready workforce as important factors in attracting these industries to a region. The Northern Neck has potential sites in both Richmond County and Westmoreland County and does have access to various modes of transportation. However, for the Northern Neck to truly reach its full potential in gaining ground in these industries, it must address current challenges in meeting workforce needs and it will need improvement of at least one corridor, namely Route 3 and the Norris Bridge. In general, a variety of infrastructure improvements will mean more shovel ready sites, with available water and sewer among the top priorities. With that in mind, Engineered Wood Products can expand, building upon the supply of lumber and the availability of sawmills, warehouses can most likely be added, and the other two industries identified in the report, plant-based food and offshore vessels, would likely grow.

PROJECTS, STRATEGY & ACTION PLAN

POTENTIAL PROJECTS

The ideas/requests raised by stakeholders in interviews and online surveys are listed below.

INFRASTRUCTURE

- Broadband service expansion – universal coverage, reliability, affordability

- Waterfront infrastructure – more access at different points along the river, transient docks, shoreline protection measures to protect waterfront property

- Dredging projects that will preserve the navigability of waterways

- Both municipal, community and private water and wastewater improvements and expansion – multiple locations

- Stormwater management systems in areas that experience frequent flooding

- Bridge widening (one bridge is owned by MD and the other two are maintained by VDOT; Norris needs repair and maintenance; replacement planned in 2038)

- Road widening in certain locations (VDOT) especially Route 3

- Industrial Park development to create more business-ready sites with infrastructure

- Address water constraints

BUSINESS ATTRACTION/RETENTION, ENTREPRENEURSHIP DEVELOPMENT

- Business attraction and development: hotels, service businesses including medical specialties, more resident-focused shopping for items such as apparel, delivery services, ride sharing, waterfront businesses to provide more activities for tourists and residents

- Incentivize water treatment facilities (reverse osmosis; entice rainwater harvesting businesses

- Small business retention program, incorporating business training in basics of running a business, e-commerce, marketing, finance, networking and provide problem solving support

- Mentoring program for entrepreneurs – form a SCORE chapter or similar entity

- Creative financing options for small businesses, such as the Revolving Loan Fund, which is capitalized at $125,000.

- Co-working spaces, particularly for those that do not have universal broadband. One proposal was written by citizens that would like to place such a facility in Lively

- Encourage small businesses to do more business with Dahlgren Naval Base

TOURISM DEVELOPMENT

- National Heritage Area Designation needs to be marketed once it becomes final

- Wayfinding signs

- More marketing of the region to tourists in multiple markets (will require greater budget than is currently available)

- Develop themed driving tours, more packages such as multiple winery tours, heritage tours, sports and nature tours. Tourism development opportunities for Adventure Sports/Outdoor activities (e.g., zip lines, horseback riding, bike trails, water sports), enhanced recreation of underutilized sites (Belle Isle State Park underutilized (awareness, programming); the new Compass Entertainment Complex; development of the Tri-Way Trail

- Specialty/Niche marketing – sport fishing, ecotourism, arts/culture, special events during shoulder and off season

- Expand capacity for lodging for small conferences and meetings, where groups can meet, dine, and stay in one location, preferably on the water.

FISHING / FARMING / AGRICULTURE DEVELOPMENT

- Certified commercial kitchen that can offer shared facilities, equipment to create value-added products, food incubator support services

- USDA Meat Processing Plant/Mobile Unit

- Working waterfront improvements

- Agritourism initiative featuring collaboration among sites, festivals and activities, promotion, “how to” support, training with examples from other successful destinations such as Shenandoah

HOUSING

- Housing study to determine needs and locations that address workforce affordability, as well as impacts of influx of new residents and growing practice of vacation homes/rentals

- More housing development, particularly for multi-family affordable housing

WORKFORCE DEVELOPMENT

- Marketing to attract new residents of working age, families

- Youth employment program to address work readiness (as a best practice, see Georgia’s Work Ready Certification) – training in work ethics, responsibilities of employees/employers, basic finance, resume writing, interviewing skills, etiquette and good customer service

- Teacher retention initiative to help improve education overall, holistic approach

- Public transportation expansion to support workforce needs

- Support for cross-communications to connect businesses with training providers

- More online training programs, especially for trades

- Construction worker shortage – address various issues such as trades training, use of shared tools and equipment

GOALS & OBJECTIVES

When evaluating and prioritizing potential projects, it may be helpful to utilize the Gauging Potential Project Importance page under the Evaluation Framework tab.

. CATEGORY 1 – INFRASTRUCTURE

PROJECT 1

SITE READINESS

Goal

To provide adequate infrastructure to support business growth and new locations

Objective

Identify at least two new sites for economic development and bring at least one to shovel ready status

Evaluation Criteria

One new site shovel ready with defined industry target to be pursued

PROJECT 2

WATERFRONT

Goal

Expand access for boaters, recreational fishing

Objective

Open at least four new waterfront access openings

Evaluation Criteria

Open for use at least 4 new waterfront access areas along the waterfront

PROJECT 3

EXPAND & MODERNIZE SEWER / WASTEWATER MANAGEMENT SYSTEM

Goal

To provide at least one major new and one major repaired sewage system

Objective

Monitor improvement in sewer/wastewater system

Evaluation Criteria

Before and after measure of wastewater system particulates

PROJECT 4

STORMWATER MANAGEMENT

Goal

To improve stormwater management and reduce damage from flooding

Objective

Add at least one improvement to the stormwater management system

Evaluation Criteria

Set measurement and benchmark for degree of flooding reduction

PROJECT 5

BRIDGE REPAIR & WIDENING

Goal

More dependable, free flowing traffic for travelers, workers, shipping

Objective

Get VDOT to invest in roads and bridges to the Northern Neck (widen Rte 3; Norris Bridge in Lancaster needs maintenance, and ultimately, replacement)

Evaluation Criteria

Repair/replace the Norris Bridge most and widen/improve state Rte 3

PROJECT 6

INDUSTRIAL / BUSINESS PARK

Goal

Get best site shovel ready to attract investment

Objective

Address infrastructure issues

Evaluation Criteria

Site ready to be promoted for new investment

. CATEGORY 2 – BUSINESS ATTRACTION, RETENTION /

EXPANSION / NEW STARTUPS

PROJECT 1

ATTRACT TOURISM VENUES

Goal

Expand on tourism activities and accommodations

Objective

Develop the product and raise outreach/marketing

Evaluation Criteria

Measure tourism expenditures, jobs, tax revenues generated

PROJECT 2

RETENTION PROGRAM / SMALL BUSINESS ASSISTANCE

Goal

Build capacity of small businesses to handle operations, marketing sales with direct business assistance

Objective

Enhance the viability and profitability of small local businesses

Evaluation Criteria

Sales and tax receipts for local businesses

PROJECT 3

ATTRACT NEW BUSINESS TO THE NORTHERN NECK

Goal

Expand the local business community through enhanced marketing, incentives, infrastructure development

Objective

Build the tax base; create quality jobs

Evaluation Criteria

Growth in commercial tax base, jobs added, impacts on local businesses

PROJECT 4

EXPAND THE WATER SUPPLY

Goal

Avoid shortages and constraints on development

Objective

Attract firms who can offer alternatives to groundwater: e.g., desalinization, rainwater harvesting

Evaluation Criteria

Number of firms attracted, new technologies utilized, increase in water supply

PROJECT 5

EXPAND ASSISTANCE FOR ENTREPRENEURS

Goal

Help grow more businesses

Objective

Create business incubator, mentoring program, SCORE Chapter

Evaluation Criteria

Number of small business startups; survival rate of new firms

PROJECT 6

EXPAND OPTIONS FOR SMALL BUSINESS FINANCING

Goal

Create Programs to make affordable loans to smaller firms

Objective

Make financing available that is affordable, quick and uncomplicated; crate revolving loan fund, possibly with bank participation (done)

Evaluation Criteria

Number small business loans made; survival rate of assisted businesses

PROJECT 7

ENCOURAGE MORE BUSINESS STARTUPS

Goal

More business “births” in NN

Objective

Make financing, incentives available for startups; launch co-working and/or incubator facility

Evaluation Criteria

Number of new business startups

PROJECT 8

CAPTURE MORE BUSINESS FROM DAHLGREN NAVAL BASE

Goal

More contracts for local firms

Objective

Take advantage of small business set asides

Evaluation Criteria

Gauge value of business generated by Dahlgren

. CATEGORY 3 – TOURISM

PROJECT 1

NORTHERN NECK NATIONAL HERITAGE AREA

Goal

Make optimal use of new designation

Objective

Market to attract tourists

Evaluation Criteria

Measure increase in tourist visits

PROJECT 2

ADD MORE WAYFINDING SIGNS

Goal

Increase tourism

Objective

Help make it easier for tourists to find destinations

Evaluation Criteria

Measure tourist visits to local destinations

PROJECT 3

MORE TOURISM MARKETING / INCREASE MARKETING BUDGET

Goal

Increase tourist visits

Objective

Reach new markets; saturate current markets

Evaluation Criteria

Measure tourist visits; source the advertising that reached them; measure hotel occupancy

PROJECT 4

DIVERSIFY TOURISM ATTRACTIONS

Goal

Attract more tourists; enrich the tourism experience

Objective

Develop themed driving tours, more packages such as multiple winery tours, heritage tours, sports and nature tours. Tourism development opportunities for Adventure Sports/Outdoor activities (e.g., zip lines, horseback riding, bike trails, water sports), enhanced recreation of underutilized sites (Belle Isle State Park underutilized (awareness, programming); the new Compass Entertainment Complex; development of the Tri-Way Trail

Evaluation Criteria

Measure visits, revenues, taxes collected

PROJECT 5

NICHE MARKETING FOR SPECIALIZED TOURISM EXPERIENCES

Goal

Attract more tourists

Objective

Spend money for Niche marketing – sport fishing, ecotourism, arts/culture, special events during shoulder and off season

Evaluation Criteria

Measure tourist visits, hotel occupancy, taxes collected

PROJECT 6

GROUP LODGING FACILITY

Goal

Ability to host small meetings and conferences

Objective

Develop a location for groups to meet, dine and stay in one location, preferably on the water

Evaluation Criteria

Development of a facility; meetings booked

. CATEGORY 4 – FISHING, FARMING, AGRICULTURE

PROJECT 1

COMMERCIAL KITCHEN

Goal

To encourage entrepreneurship; serve existing food companies and producers

Objective

Identify or create a commercial kitchen that can be utilized by food cooperatives, local farmers, small businesses; serve as a food business incubator

Evaluation Criteria

Open the commercial kitchen; spawn new businesses; increase sales by food businesses and entrepreneurs

PROJECT 2

MORE PROCESSING FACILITIES, POSSIBLY TO INCLUDE A “MOBILE’ FACILITY

Goal

Provide local services to food producers; add potential markets for local agricultural businesses

Objective

Open new opportunities for food producers and increase sales

Evaluation Criteria

Welcome new facilities; measure processed food sales

PROJECT 3

WATERFRONT IMPROVEMENT

Goal

To make it easier for working watermen

Objective

Upgrade working waterfront facilities

Evaluation Criteria

Improve revenues for the watermen; jobs added

. CATEGORY 5 – HOUSING

PROJECT 1

ASSESS THE NEED FOR WORKFORCE HOUSING

Goal

Ensure that there is adequate housing for the workers that employers need (and their families)

Objective

Study the availability of affordable workforce housing and ways to fill any gaps

Evaluation Criteria

Review housing availability at selected prices; have more workers moved to the Northern Neck

. CATEGORY 6 – TAX AND ENVIRONMENTAL POLICY

PROJECT 1

USE LOCAL AND STATE INCENTIVES TO

ATTRACT INDUSTRY

Goal

Attract more businesses

Objective

Take advantage of VA Clean Economy Act and Green Development Zone Authorization

Evaluation Criteria

Monitor investment in clean and green technologies

. CATEGORY 7 – WORKFORCE DEVELOPMENT

PROJECT 1

ATTRACT MORE WORKERS TO THE NORTHERN NECK

Goal

Expand the workforce

Objective

Conduct marketing and develop incentives to attract new workers and bring back homegrown talent

Evaluation Criteria

Number of working age men and women move to or join the workforce; monitor median age of population

PROJECT 2

UNDERTAKE PROGRAM TO BOLSTER READINESS OF THE EXISTING WORKFORCE

Goal

Help meet employer needs

Objective

Assist workers with work readiness, including training in soft skills for younger workers

Evaluation Criteria

Employers who are able to fill jobs; number and percentage of workers who find jobs; percentage of employed workforce

PROJECT 3

TEACHER RETENTION

Goal

Find and keep qualified teachers

Objective

Identify incentives that appeal to local teachers, including salary and benefits

Evaluation Criteria

Retention rate of current teachers

PROJECT 4

CONDUCT A STUDY TO DETERMINE PUBLIC TRANSPORTATION OPTIONS

Goal

Ensure that teachers and other local workers can get to work

Objective

Find an affordable way for the community to meet the local travel options for workers

Evaluation Criteria

Assess the effectiveness of new transportation options in terms of number of workers using that transportation

PROJECT 5

IMPROVE COMMUNICATION BETWEEN TRAINERS AND EMPLOYERS

Goal

Bring trainers and employers into closer communication; foster collaboration so that trainers can best meet employer needs and employers can be aware of training resources

Objective

Attain a better matchup between employers and trainers in order to optimize the utilization of current resources for supporting business growth

Evaluation Criteria

Monitor job openings that are getting filled; track jobs filled locally by people seeking employment

PROJECT 6

FOCUS ON FACILITATING GROWTH IN KEY INDUSTRIES

Goal

To solidify their position in the Northern Neck, create jobs, leverage growth

Objective

Work with RCC and other trainers to meet training needs in industries that show potential for growth, including construction, marinas/aquaculture, light manufacturing, timber, tourism

Evaluation Criteria

Monitor economic indicators for core industries

EVALUATION FRAMEWORK

OVERVIEW ON PERFORMANCE MEASUREMENT

The previous section lists evaluation criteria that can be used to gauge the outputs and impacts that can help assess the effectiveness of each project. However, each of those measures are simply “intermediate outcomes” as they are outputs, and/or part of gauging a means to an end.

The ultimate impacts of this entire strategy will, in the end, need to be measured for the impact it has on the investment leveraged, jobs created, taxes paid, median income, drops in the percentage of those living in poverty, and improvement of the overall economy.

Thus, this section offers suggestions of other performance measures that may be used to assess the overall performance of the CEDS strategy. The key, however, is to use patience in developing performance measurement metrics. It is important to use a timed approach to performance measurement if one is to find ways to truly assess the impact of programs.

There are three levels of measurement: outputs, intermediate outcomes, and end-result outcomes. The measures suggested for each individual project provide outputs and some intermediate measures, which will indicate preliminary results towards achieving the ultimate ends.

For longer-term results, program managers need to focus on the end results, the economic development impacts. Those ultimate outcomes for the Northern Neck strategy should include:

Population Growth – growth in population, but especially growth in the proportion of workers, aged 18 to 55. This should also be reflected in lowering the median age of the population.

METRICS TO MONITOR

Poverty Levels and Other Economic Indicators – steadying, and preferably lowering the poverty levels in the four counties. In addition, local officials should closely monitor commercial tax revenues, the number of new jobs created, median incomes and median home and property values. Visits by travelers and tourists, and their local expenditures should also be tracked.

METRICS TO MONITOR

The number of businesses – number of businesses locating or expanding in the Northern Neck, as well as the birthrate of new local businesses will be important indicators of strategy effectiveness.

METRICS TO MONITOR

In short, rising economic activity should positively impact the economic indicators tracked by state employment commissions, state tax offices, as well as the Census Bureau, and the County Business Patterns, the Bureau of Labor Statistics and state Tourism agencies.

Suggested path: look for outputs and intermediate results by the end of the year. Outputs are defined in the section on each project. Intermediate outcomes can include rising hits on local websites, new investment prospects, rising numbers of visitors and hotel occupancy rates. Workers signing up for skills training programs and business hires should begin to rise.

GAUGING POTENTIAL PROJECT IMPORTANCE

CEDS EVALUATION CRITERIA FOR THE NORTHERN NECK

Each project or initiative is given a score. Some criteria may be given higher weighting than others, depending upon the values of the community and how much impact it will have on economic recovery / progress.

Tourism Impact

| Project Criterion | Score Guidelines |

| Project will support the revitalization or improvement of tourism | 5 Fulfills significant tourism growth as identified by local sources |

| 4 Supports moderate tourism growth as identified by local sources | |

| 3 Provides minimal tourism impact | |

| 2 Does not impact tourism | |

| 1 Negative impact on tourism likely |

Agriculture / Fishing Impact

| Project Criterion | Score Guidelines |

| Project will benefit agriculture or fishing industries | 5 Meets significant needs |

| 4 Meets moderate needs as identified by industries | |

| 3 Meets minimal needs | |

| 2 Does not meet needs identified | |

| 1 No impact |

Economic Diversification Impact

| Project Criterion | Score Guidelines |

| Project will help diversify the economy | 5 Will significantly diversify |

| 4 Moderate diversification | |

| 3 Minimal diversification | |

| 2 Does not diversify | |

| 1 No impact |

Defense Impact

| Project Criterion | Score Guidelines |

| Project will provide benefit to military base | 5 Meets significant needs |

| 4 Meets moderate needs as identified by industries | |

| 3 Meets minimal needs | |

| 2 Does not meet needs identified | |

| 1 No impact |

Revitalization Impact

| Project Criterion | Score Guidelines |

| Project will help revitalize community or downtown | 5 Will significantly benefit revitalization |

| 4 Moderate benefit | |

| 3 Some minor benefit | |

| 2 Does not benefit | |

| 1 No impact |

Employment Impact

| Project Criteria | Score Guidelines |

| Project will generate direct employment in the construction industry | 5 Creates or supports more than 100 jobs in construction |

| 4 Creates 60 – 100 jobs | |

| 3 Creates 30 – 59 jobs | |

| 2 Creates less than 30 jobs | |

| 1 No employment impact | |

| Project will generate increase in long-term employment | 5 Will create 100+ new long-term positions |

| 4 Will create 60 – 100 long-term positions | |

| 3 Creates 30 – 59 new long-term positions | |

| 2 Creates less than 30 long-term positions | |

| 1 No employment impact | |

| Project will lead to improved job skills and higher-paying jobs for residents | 5 Project provides significant direct impact |

| 4 Project provides moderate direct impact | |

| 3 Project provides slight direct impact | |

| 2 Project does not have direct impact | |

| 1 Project may have a negative impact |

Maximizing Leverage of Private Sector Investment

| Project Criterion | Score Guidelines |

| Private Sector Investment as percentage of project cost | 5 Fully funded by private sector |

| 4 More than 50% privately funded | |

| 3 Private sector interest expressed in funding participation | |

| 2 Potential for private sector investment | |

| 1 Fully funded by public sector |

Financial Sustainability

| Project Criterion | Score Guidelines |

| Degree of long-term (post-construction) public sector funding required | 5 Project is net revenue generator |

| 4 Reduced or no public sector support required | |

| 3 No impact on public sector support required | |

| 2 Slight increase in direct public sector support required (less than $100k) | |

| 1 Significant increase in direct public sector support required |

Local Community Priority / Champions

| Project Criterion | Score Guidelines |

| Project priority according to the local community | 5 Number 1 priority |

| 4 Number 2 priority | |

| 3 Number 3 priority or lower | |

| 2 Not identified as priority | |

| 1 Significant local opposition |

Sustainable Growth

| Project Criteria | Score Guidelines |

| Project minimizes potential impacts to shorelines, reefs, wetlands, critical habitats and other environmentally sensitive areas. | 5 Project will redevelop an existing commercial or industrial property |

| 4 Project is located more than 1,000 feet from any environmentally sensitive area | |

| 3 Project is located at least 500 but less than 1,000 feet from any environmentally sensitive area | |

| 2 Project is located at least 250 but less than 500 feet from any environmentally sensitive area | |

| 1 Project is within 250 feet of an environmentally sensitive area | |

| Project environmental footprint (e.g., carbon emissions, other impacts) | 5 Project will reduce environmental footprint |

| 4 No net impact | |

| 3 Potential minor increase to environmental footprint | |

| 2 Known minor increase to environmental footprint | |

| 1 Significant increase to environmental footprint |

Resilience

| Project Criterion | Score Guidelines |

| Project will help promote a resilient economy that can bounce back more easily from shocks | 5 Project substantially mitigates a known threat |

| 4 Project helps mitigate a threat | |

| 3 Project promotes resilience but is difficult to measure | |

| 2 Project seems to promote resilience but with no way to measure | |

| 1 Project has no benefit in terms of resilience |

Implementation Timeline

| Project Criterion | Score Guidelines |

| Time required to implement project (Implementation defined as project being operational.) | 5 Less than 1 year |

| 4 1 – 2 years | |

| 3 2 – 3 years | |

| 2 3 – 4 years | |

| 1 4 or more years |

ECONOMIC RESILIENCE

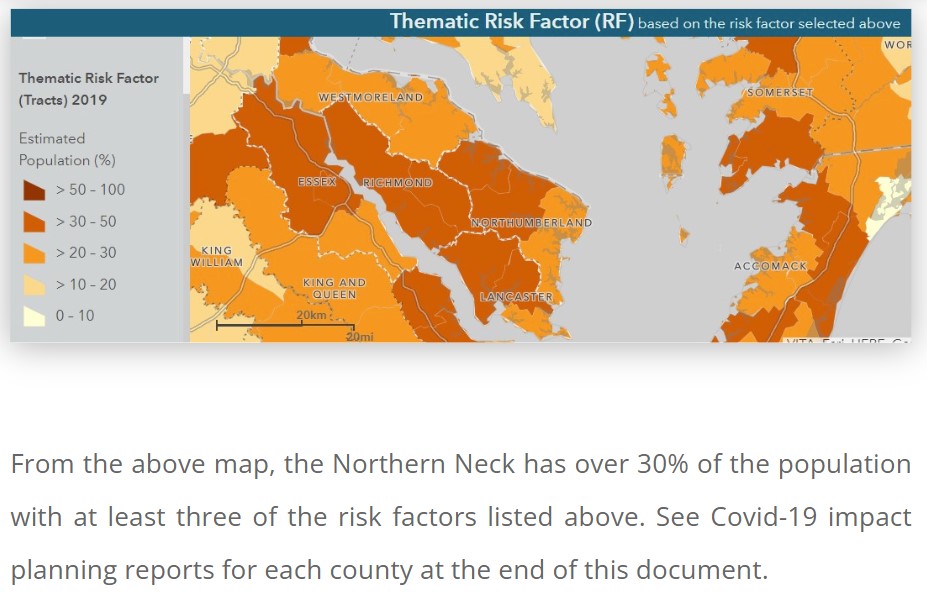

The US Census’ 2019 Community Resilience Estimates rate counties, down to the census block level, according to their population’s exposure to various risks. The risk factors from the 2019 ACS include:

- Income to Poverty Ratio

- Single or Zero Caregiver Household

- Crowding

- Communication Barrier

- Households without Full-time, Year-round Employment

- Disability

- No Health Insurance

- Age 65+

- No Vehicle Access

- No Broadband Internet Access

With respect to economic resiliency, the region has a head start through the work of the ODU Institute for Coastal Adaptation and Resilience. The institute developed a Coastal Virginia Small Business Resilience Self-Assessment and Guide for the RAFT ((Resilience Adaptation Feasibility Tool). The Guide articulates four basic principles that can allow businesses to assess their level of resilience and to craft a plan to increase resilience.

For self-assessment, the Guide divides the effort as having four categories to explore, including:

- Business planning including strategic planning, planning for use of E-Commerce and online sales and succession and exit planning;

- Emergency and disaster planning regarding risk and assessing their vulnerability, preparedness, continuity of operations and planning for crisis and emergencies (including communication options);

- HR and staffing, including hiring, training and retention of employees;

- Insurance and other protection for risk management, to insure, protect and secure physical assets and cybersecurity.

The Guide goes on to include a questionnaire that allows local businesses to conduct self-assessment for resiliency and to help build stronger resiliency. This ongoing support, strengthened by the RAFT program, is a tremendous resource for businesses in the region which, in turn, strengthens the regional economy in the face of future disasters.

Regarding the regional economy, the NNPDC has already taken the lead through development and regular updating of the Comprehensive Economic Development Strategy, which ensures strategic planning and regional coordination, both important to recovery and resiliency.

Nevertheless, there are issues of industry and infrastructure that will help determine the degree to which the region stabilizes, grows and prospers.

First and foremost, may be the ability of the Northern Neck to grow its tourism industry. The Northern Neck boasts several lovely and charming small towns, all of which appear healthy and active. This applies to the philosophy of “play to your strengths”.

But for tourism to flourish, the region needs:

- Qualified hospitality staff for restaurants, hotels, and BNBs, all of whom are struggling now to staff their venues

- More accommodations that can handle travelers

- More entertainment venues

- More forms of tourist activities and entertainment

- More funds spent on marketing and

- An Aggressive campaign to promote the new designation as a National Heritage Area, once Congress acts on the measure

Perhaps the single most important new element in the future of the Northern Neck is the impending designation of the region as a National Heritage Area. According to the National Park Service, this can be a turning point for travel and tourism to the region, can help bolster the historic and cultural identity of the area and bring needed resources to the Northern Neck economy.

The Northern Neck Tourism Commission states:

“Under this legislation, and as approved by the NPS [National Park Service] study, the heritage area would be managed by the Northern Neck Tourism Commission, which would serve as the NHA’s local coordinating entity.”

The NHA goes on to state that, this legislation would also make federal funding available to the region and empower the commission to carry out an area management plan, including by:

- Protecting and restoring relevant historic sites and building

- Carrying out programs and projects that recognize, protect, and enhance important resources

- Developing recreational and educational opportunities in the area

- Establishing and maintaining interpretive exhibits and programs

- Promoting a wide range of partnerships among the federal government, state, tribal and local governments, organizations, and individuals

- Increasing public awareness and appreciation for natural, historical, scenic, and cultural resources in the area; and

- Ensuring that clear, consistent, and appropriate signs identifying points of public access and sites of interest are posted throughout the area

It would be unfair to characterize the National Heritage Area designation as the only key to regional rebound and growth. However, according to the National Park Service, some of the long-term benefits of NHA activities include:

- Sustainable economic development – NHAs leverage federal funds (NHAs average $5.50 for every $1.00 of federal investment) to create jobs, generate revenue for local governments, and sustain local communities through revitalization and heritage tourism

- Healthy environment and people – Many NHAs improve water and air quality in their regions through restoration projects, and encourage people to enjoy natural and cultural sites by providing new recreational opportunities.

- Improved Quality of Life –Through new or improved amenities, unique settings, and educational and volunteer opportunities, NHAs improve local quality of life. Education and Stewardship – NHAs connect communities to natural, historic, and cultural sites through educational activities, which promote awareness and foster interest in and stewardship of heritage resources.

- Community Engagement and Pride – By engaging community members in heritage conservation activities, NHAs strengthen the sense of place and community pride.

And, finally, the NPS offers facts about NHAs:

- Fifty-five NHAs have been designated by Congress since 1984. Each NHA is created through individual federal law.